TAX TOOLS

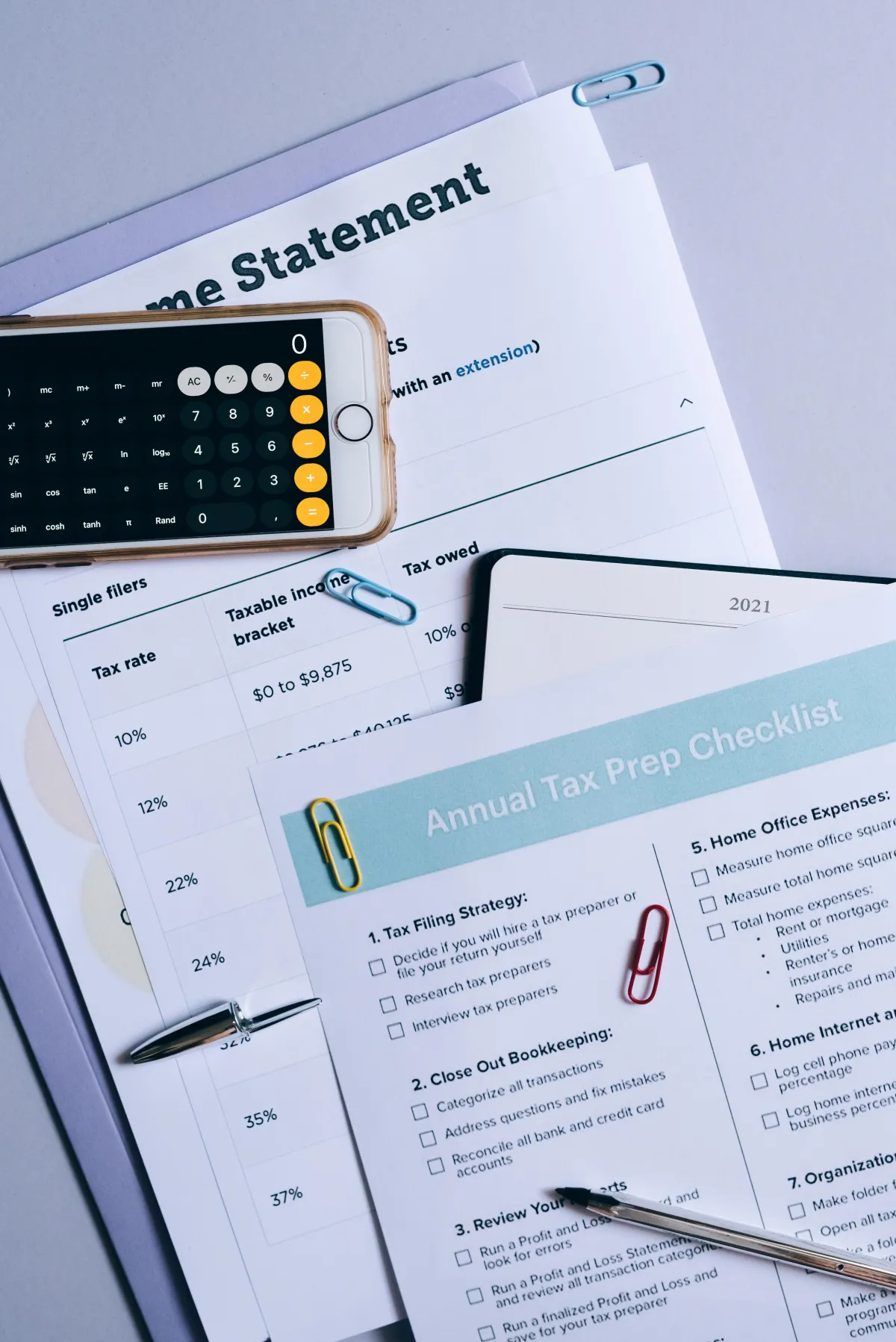

INCOME TAX CALCULATOR

TRACK REFUND WITH THE IRS

ABOUT / INFO

DEADLINES & DATES

SERVICES

TAX PREPARATION

PAYROLL

BOOKKEEPING

FINANCIAL CONSULTATION

Copyright © 2023 aphroditetax.com. All rights reserved. How was your experience? Please leave us feedback